Investing Made Simple for Health Systems

Our Process

We make it simple for Health System Limited Partners (LPs) to participate in venture capital.

DISCOVER

Hatteras and LPs source and evaluate promising early-stage companies as a fund

ENGAGE

Limited Partners join bi-weekly calls to weigh in on clinical and operational fit

VALIDATE

Limited Partners have the opportunity to participate in pilots or trials

DECIDE

Hatteras manages operational, legal, and financial execution on behalf of LPs

REALIZE

Health systems benefit from strategic impact and financial returns

Benefits for Health System Limited Partners

By joining the Healthcare Innovation Venture Fund, health systems gain the strategic value of an internal venture fund without the overhead.

Our approach delivers:

Access to larger check sizes and better terms as a lead investor

Enhanced physician recruitment and retention through collaboration on cutting-edge technologies

Opportunities for pilot programs and clinical trials in their system

Investment expertise from Hatteras that complements your subject matter expertise

The ability to shape decisions for the fund

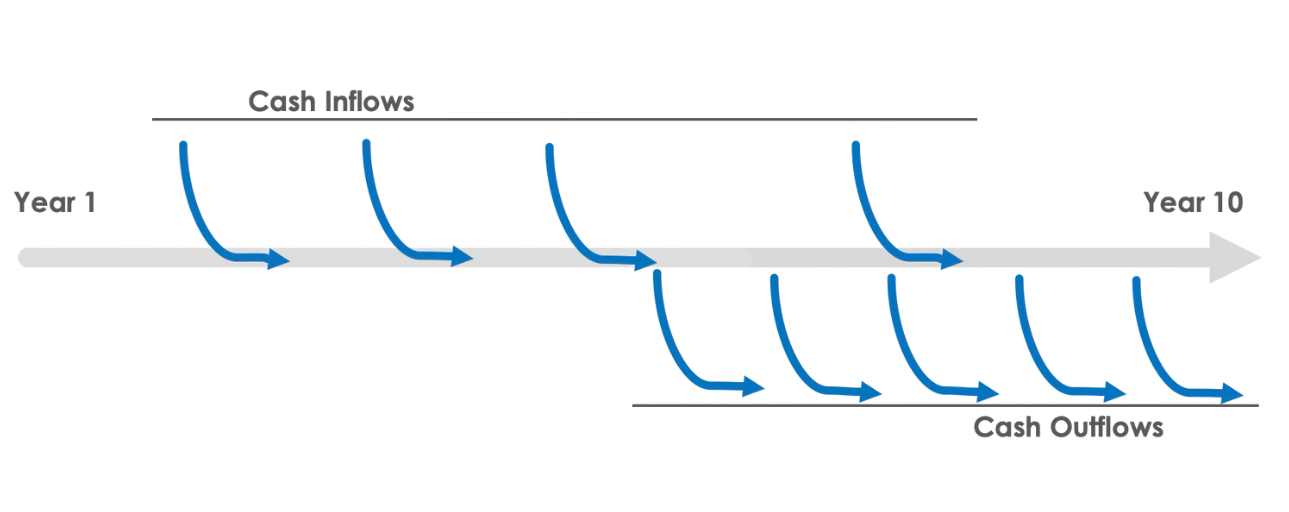

Commitment Structure Designed for Community Health Systems

We understand the budget pressures faced by community health systems – the Healthcare Innovation Venture Fund is structured to accommodate those needs.

Capital is called over the lifetime of the fund, not all up front

Returns begin flowing as investments mature and exit

Health systems can stay focused on care delivery – while Hatteras handles the investment process